Global transactions re-invented

Customers and businesses in today’s interconnected world expect a quick, seamless, and reliable way to purchase goods or conduct businesses worldwide. Supply chains in a multitude of sectors are broadening, creating more complex value chains. Developments like blockchain and the integrated use of advanced analytics and machine learning (AAML) are moving global transactions into the future. In recent years, financial technology entrants as well as banks have created new solutions to address key pain points related to transactions, payments, trade finance, and cash management. For financial institutions, these developments result in tighter competition for market share gain.

To discuss these topics and the latest trends in the movement of money and international transactions, The Asian Banker will gather experts from the global transaction banking industry. The Future of Finance Summit 2018 provides a platform for thought-leaders to share their outlooks and offer best practice solutions to stay ahead of the curve.

Key focus areas:

Global outlook for global trade and transactions

Seamless, safe, transparent and frictionless cross-border payments for a globalised world

New technologies in a shifting compliance landscape

Going virtual: Building the future of cash management

Real-time payment transformation domestically and globally

Customer experience and service proposition in the digital age

Developments in supply chain finance and logistics

Where tradition meets technology: Exploring hybrid model between banks and fintechs

The role of blockchain in cross-border and domestic transaction banking

08:00 |

Registration & Morning Networking |

|

09:00 |

Welcome remarks Opening keynote International keynote

Future of personal finance - Change versus constant Leadership dialogue: The shift of global finance

|

|

11:00 |

Networking break |

|

11:30 |

Frictionless transactions and seamless payments of the future

|

|

13:00 |

Luncheon |

|

14:30 |

Regtech and compliance - Not just a simple cost-benefit equation

|

|

15:30 |

Going virtual: Building the future of cash management

|

|

| 16:30 | Networking break | |

| 17:00 | Day 1 - Closing keynote Technology is reshaping what we believe, can we trust it?

|

|

18:00 |

Close of conference day one |

|

08:30 |

Registration & Morning Networking |

|

09:00 |

Where tradition meets technology: Innovations in supply chain logistics

|

|

10:30 |

Networking break |

|

11:00 |

Correspondent banking in a decentralised world – Implication of Open Banking, APIs and Blockchain

|

|

12:00 |

Strong demand for enhanced cross-border and regional financial infrastructure and services

|

|

13:00 |

Luncheon |

|

14:30 |

China and U.S. calling the shape of global trade to come

Speakers/panellists include:

|

|

15:30 |

Networking break |

|

| 16:00 | Future of Finance Summit 2018 - Closing keynote session Reimagining new ecosystems of finance

Speakers/panellists include:

|

|

17:00 |

Close of conference day two |

|

Featured keynote speakers from 2017

-

Barney Frank,

Barney Frank,

Former congressman, co-author of Dodd-Frank Act -

Cathy Lemieux,

Cathy Lemieux,

EVP, Supervision and Regulation, Federal Reserve Bank of Chicago -

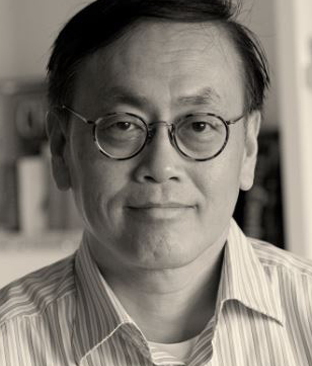

David Shrier,

David Shrier,

Founder and New Ventures, Massachusetts Institute of Technology (MIT) -

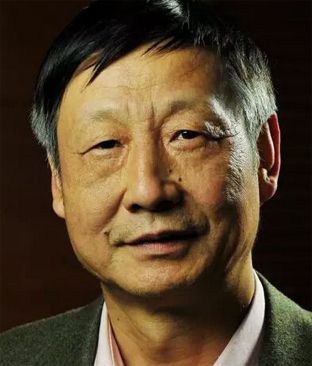

Tang Ning,

Tang Ning,

Founder and CEO, CreditEase -

Slava Solodkiy, Managing Partner, Life.SREDA

Slava Solodkiy, Managing Partner, Life.SREDA

Featured speakers from 2017

-

Kanags Surendran,

Kanags Surendran,

Managing Director and Head, Digital Banking, CIMB Bank Berhad -

Bernard Leong,

Bernard Leong,

Head, Post Office Network and Digital Services, Singapore Post Pte Ltd -

Ron Hose,

Ron Hose,

Co-Founder and CEO, Coins.ph -

Olivier Berthier,

Olivier Berthier,

Co-Founder and CEO, Moneythor -

Vidit Agrawal,

Vidit Agrawal,

Strategic Vehicle Partnerships Lead, APAC, Uber

-

Stephanie Myers,

Stephanie Myers,

Vice President Customer Strategy, Experience and Loyalty, Prudential -

Sreeram Iyer,

Sreeram Iyer,

COO, Institutional Banking, ANZ -

Lito Villanueva,

Lito Villanueva,

Managing Director, FINTQ by PLDT -

Raju Nair,

Raju Nair,

Managing Director- Regional Head Customer Journey Experience, DBS Bank -

Natividad Alejo,

Natividad Alejo,

Executive Vice President, Consumer Banking Group Head, Bank of the Philippine Islands

Moderators

-

Richard Hartung,

Richard Hartung,

International Resource Director, The Asian Banker -

Matt Dooley,

Matt Dooley,

International Resource Director, The Asian Banker -

Sam Ahmed,

Sam Ahmed,

Managing Director, Deriv Asia -

Conor Cunningham,

CEO, ACUO -

Thomas McMahon,

Thomas McMahon,

CEO, PACE -

Emmanuel Daniel, Chairman, The Asian Banker

Emmanuel Daniel, Chairman, The Asian Banker -

Gordian Gaeta, International Resource Director, The Asian Banker

Gordian Gaeta, International Resource Director, The Asian Banker

Who will attend?

The programme is designed for senior executives from:

- Transaction banking and cash management

- Technology, operations, data and analytics

- Trade finance

- Cross-border corporate payments

- Transaction banking regulation

- Logistics and supply chain finance

- Financial technology start-ups, blockchain companies, alternative providers of financing and e-commerce

Please submit the required information in order to reserve your seat in The Future of Finance Summit.

We will contact you shortly with the registration confirmation and more exciting details!

Ron Suber,

Ron Suber,  Soul Htite,

Soul Htite,  Sameer Gupta,

Sameer Gupta,  Mark Mackenzie,

Mark Mackenzie,  Suhail Amar Suresh,

Suhail Amar Suresh,  Gitesh Athavale,

Gitesh Athavale,  Neil Parekh,

Neil Parekh,  Ng Ling Soon,

Ng Ling Soon,  Val Jihsuan Yap,

Val Jihsuan Yap,  Michael Lor,

Michael Lor, Hitesh Arora,

Hitesh Arora,  Alvin Wong,

Alvin Wong,  Ron Leven,

Ron Leven,  Jinesh Patel,

Jinesh Patel,  Jefferson Chen,

Jefferson Chen,  Nick Walton,

Nick Walton,  Mike Kayamori,

Mike Kayamori, Marcelo Casil,

Marcelo Casil,  Ganesh Iyer,

Ganesh Iyer,  John Bailon,

John Bailon, R Vivekanand,

R Vivekanand,  Andrew Tan,

Andrew Tan,