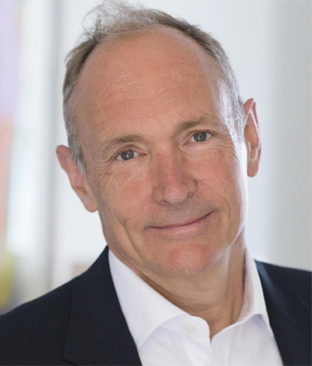

Featuring keynote speaker Sir Tim Berners-Lee who will share his vision of the future of financial services industry in the digital world, along with disruptive founders, innovators and people changing the industry

-

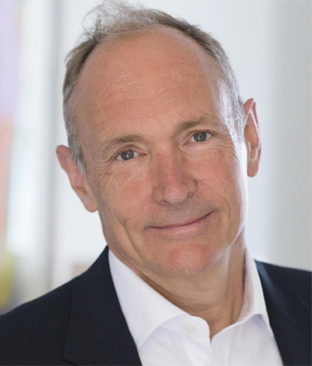

Sir Tim Berners-Lee,

Sir Tim Berners-Lee,

Inventor of the World Wide Web, President & Founder, Open Data Institute -

Jackson Cheung,

Jackson Cheung,

CEO & Co-founder, Youxin Financial -

Vladislav Solodkiy,

Vladislav Solodkiy,

Managing Partner, Life.Sreda and CEO, Arival Bank -

Alain Falys,

Alain Falys,

Chairman & Co-Founder, Yoyo Wallet -

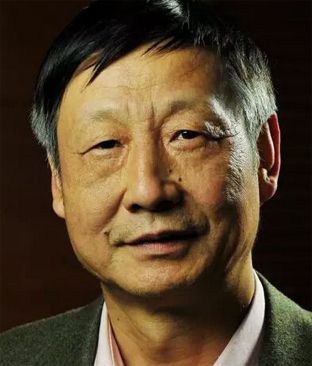

Frank Wang,

Frank Wang,

Managing Director, CreditEase Wealth Management -

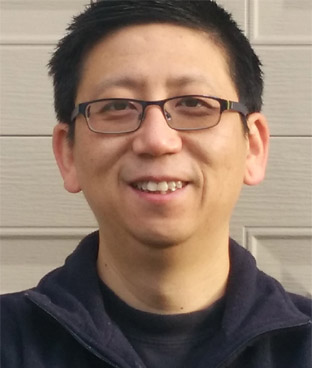

Vincent Chen,

Vincent Chen,

CTO, Financial Services Sector, Enterprise Business Group, Huawei Technologies Co., Ltd. -

Heike Winter,

Heike Winter,

Director, Retail Payments Policy, Deutsche Bundesbank -

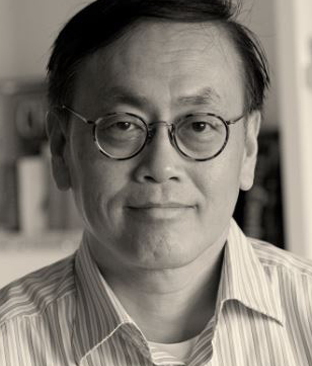

Yao Huiya,

Yao Huiya,

Head, FinTech Innovation, WeBank (Tencent) -

Kartik Athreya,

Kartik Athreya,

Executive Vice President & Director of Research, U.S. Federal Reserve Bank of Richmond -

Wu Kedi,

Wu Kedi,

Vice President, Neo Online (Neo Capital) -

Ghela Boskovich,

Ghela Boskovich,

Head of Fintech,Rainmaking Innovation -

Navin Gupta,

Navin Gupta,

Managing Director, South Asia & MENA, at Ripple -

Zhou Zhihan,

Zhou Zhihan,

CEO, Kaixin Financial Service Co. Ltd -

Wang Jicheng,

Wang Jicheng,

Deputy General Manager, Kaixin Financial -

David Brearley,

David Brearley,

Head of Consulting, Silverlake Group -

Jackal Ma,

Jackal Ma,

Co-Founder & Partner, Tongdun Technology -

Ayumi Konishi,

Ayumi Konishi,

Special Senior Advisor to the President, Asian Development Bank -

Ricardo Gonçalves,

Ricardo Gonçalves,

Head of APAC Intelligence, Barclays Group Chief Security Office -

Roeland van Zeijst,

Roeland van Zeijst,

Global cyber security strategist, RovaZ.com and Former, Digital Crime Officer, Interpol, Singapore -

Sam Tidswell-Norrish,

Sam Tidswell-Norrish,

Principal at Motive Partners & Chief of Staff to UK Prime Minister’s Business Ambassador for FinTech -

Daniel Gusev,

Daniel Gusev,

Managing Partner, Gauss Ventures and Russian FinTech Association Envoy -

Jakub Zakrzewski,

Jakub Zakrzewski,

International Expansion GM, Revolut -

Wan Zulhamli bin Wan Abdul Rahman,

Wan Zulhamli bin Wan Abdul Rahman,

Head of Strategic Research and Advisory department, CyberSecurity Malaysia, under the Ministry of Science, Technology and Innovation (MOSTI) -

Peter Gubarevich,

Peter Gubarevich,

Ethical Hacker & Systems Architect, JSC OlainFarm, Latvia -

Stéphane Nappo,

Stéphane Nappo,

Global Chief Information Security Officer & Board advisor, Société Générale -

Dr. Dan Wang,

Dr. Dan Wang,

Secretary General, China Association of Microfinance -

John Wong,

John Wong,

Head of Global Liquidity & Cash Management, Hang Sang Bank Limited -

Amol Bahuguna,

Amol Bahuguna,

Head of Payments and Cash Management, Commercial Bank of Dubai -

Ming Zhao,

Ming Zhao,

Professor, School of Computing, Informatics and Decision Systems, Arizona State University, USA -

Han Ying,

Han Ying,

Policy Director, United States Information Technology Office (USITO) -

Rani Sweis,

Rani Sweis,

Ex-Googler & Creative Director, Attic Salt -

Jovilyn Cotio,

Jovilyn Cotio,

Supply Chain Finance Consultant, Asian Development Bank (ADB) -

Jacqueline Alexis Thng,

Jacqueline Alexis Thng,

Partner, Prophet -

Xingfei Chen,

Xingfei Chen,

Head of Transaction Banking Department, China Guangfa Bank (HQ) -

Urs Bolt,

Urs Bolt,

Fintech & Regtech Expert -

Zong Liang,

Zong Liang,

Lead Researcher, Bank of China -

Cao Yuanzheng,

Cao Yuanzheng,

Chairman, BOCI Research -

Richard Jones,

Richard Jones,

Business Development Director, AIIB-EBRD -

Aidil Zulkifli,

Aidil Zulkifli,

CEO & Co-Founder, UangTeman -

Chengyun Chu,

Chengyun Chu,

CEO and Co-Founder, C2SEC -

Alex Medana,

Alex Medana,

Co-Founder & CEO FinFabrik -

David Chance,

David Chance,

Senior Executive, Payments Strategy, Fiserv -

Daniel Hu,

Daniel Hu,

Head of corporate Banking, Greater China, Barclays -

Fangfang Jiang,

Fangfang Jiang,

Senior Operations Officer, Financial Institutions Group -

Zhang Xia,

Zhang Xia,

Principal Enterprise Evangelist, Greater China, Amazon Web Services -

Adinata Widia,

Adinata Widia,

Senior Vice President Transaction Banking Wholesale Product Group, Bank Mandiri -

Silawat Santivisat,

Silawat Santivisat,

Executive Vice President, Kasikornbank -

Brian W Tang,

Brian W Tang,

Managing Director, Asia Capital Markets Institute -

Ricco Zhang,

Ricco Zhang,

Director, Asia Pacific, International Capital Market Association -

Edward Tse,

Edward Tse,

Author of the books: The China Strategy (2010) and China’s Disruptors (2015) -

Jan Luebke,

Jan Luebke,

Head of Market Management, Asia Pacific, Institutional Cash Management, Deutsche Bank -

Christian Westerhaus,

Christian Westerhaus,

Managing Director, Global Head of Clearing Products, Cash Management, Global Transaction Banking, Deutsche Bank -

Boon-Hiong Chan,

Boon-Hiong Chan,

Director Head of Market Advocacy, Asia Pacific Business Control Unit, Global Transaction Banking, Deutsche Bank AG Singapore -

Shekhar Bhandari,

Shekhar Bhandari,

Senior Executive Vice President and Business Head, Global Transaction Banking and Precious Metals, Kotak Mahindra Bank -

Jason Zhengrong Lu,

Jason Zhengrong Lu,

Head & Lead Infrastructure Finance Specialist,Global Infrastructure Facility -

Xu Ningning,

Xu Ningning,

Executive President, China-ASEAN Business Council -

Ang Xing Xian,

Ang Xing Xian,

Chief Executive Officer and Co-Founder, CapitalBay -

Kiran Bajaj,

Kiran Bajaj,

Senior President, Business and Digital Technology Solutions Group, Yes Bank -

Wang Wen,

Wang Wen,

Chief Economist, China Export & Credit Insurance Corp -

Yuexi Li,

Yuexi Li,

Deputy General Manager, Channel and Operations Management Department, China Construction Bank -

Dai-Kyu Kim,

Dai-Kyu Kim,

Founder/Principal, Blockonomics.IO -

Matthew Graham,

Matthew Graham,

General Manager, Greater China, Nuggets -

Yang Jinzhong,

Yang Jinzhong,

Executive Director of Global Business Development Department, Shanghai Stock Exchange -

Hu Bofei,

Hu Bofei,

Deputy General Manager of International Business Department, CCB -

Sui Dan,

Sui Dan,

Research Consultant of Institution Development Division, Financial Services Bureau of Shanghai Pudong New Area -

Zhou Jingtong,

Zhou Jingtong,

Head and Researcher of the Institute of International Finance, Bank of China -

Shen Min,

Shen Min,

Deputy General Manager of Global Finance Department, Industrial and Commercial Bank of China (ICBC) -

Lessing Wang,

Lessing Wang,

Senior Solution Consultant, Corporate Banking Solutions Practice, Oracle Financial Services Global Business Unit

Moderated by a team of highly incisive commentators

-

David Gyori,

David Gyori,

CEO, Banking Reports -

Gordian Gaeta,

Gordian Gaeta,

International Resource Director, The Asian Banker -

Bill Chua,

Bill Chua,

International Resource Director, The Asian Banker -

Mathew Welch,

Mathew Welch,

International Resource Director, The Asian Banker -

Richard Hartung ,

Richard Hartung ,

International Resource Director, The Asian Banker -

Hwa Erh-Cheng

Hwa Erh-Cheng

Chief Economist, Baoshang Bank -

Tom Groenfeldt,

Tom Groenfeldt,

Writer, Forbes -

Jame DiBiasio,

Jame DiBiasio,

Co-Founder & Editor, DigFin Group -

Andra Sonea,

Andra Sonea,

Former - Lead Solutions Architect, Innovation & Digital Development Directorate, Lloyds Banking Group, UK -

Shirley Yu,

Shirley Yu,

Financial Media Personality -

Emmanuel Daniel,

Emmanuel Daniel,

Chairman, The Asian Banker -

Foo Boon Ping,

Foo Boon Ping,

Managing Editor, The Asian Banker -

Neeti Aggarwal,

Neeti Aggarwal,

Senior Research Manager, The Asian Banker

Advisory council

Mr. Lessing Wang, Senior Solution Consultant, Corporate Banking Solutions Practice, Oracle Financial Services Global Business Unit

Lessing Wang is a senior solution consultant of corporate banking solutions practice at Oracle Financial Services Global Business Unit. He focuses on different solutions for corporate banking and financial institutions, covering several market needs such as transaction banking, streamlining credit management, and open banking and application programming interface platforms. Wang has been in the banking sector for nearly 30 years and has worked with different core banking solution vendor companies. He started his banking career at China Construction Bank and worked in different departments such as accounting, treasury back office, and trade finance. Wang will share his views on the impact of open banking, APIs and blockchain to correspondent banking today.

Mr. Matthew Graham, General Manager, Greater China, Nuggets

Matthew Graham is Nuggets Grater China General Manager, focused on bridging the Nuggets vision to the world’s largest and most critically important e-commerce market. Matthew’s unique skill set bridges tech and finance. Fluent in Mandarin, he has seven years of experience in developing strategic relationships and partnerships in China for some of the world’s most innovative international companies.

Ms. Shen Min, Deputy General Manager of Global Finance Department, Industrial and Commercial Bank of China (ICBC)

Shen Min is the Deputy General Manager of Global Finance Department of Industrial and Commercial Bank of China (ICBC). She has served in ICBC for 23 years with extensive experience in global power and energy finance, aviation ffinance, shipping ffinance, global syndication, export finance and etc. Shen Min holds a Master’s degree in Accounting and Finance from London School of Economics and Political Science.

Mr. Zhou Jingtong, Head and Researcher of the Institute of International Finance, Bank of China

Zhou Jingtong is the head and researcher of the Institute of International Finance at Bank of China.

Ms. Sui Dan, Research Consultant of Institution Development Division, Financial Services Bureau of Shanghai Pudong New Area

Sui Dan is the research consultant of Institution Development Division, Shanghai Pudong New Area Financial Services Bureau. In her long service dedicated to international exchange and financial services, Sui worked at Liaoning Province Garments Import & Export Co., Shanghai Local Products Import & Export Co., Pudong New Area Foreign Affairs Office, Pudong New Area International Exchange and Pudong New Area Financial Services Bureau.

Ms. Hu Bofei, Deputy General Manager of International Business Department, CCB

Ms. Hu Bofei, the deputy general manager of International Business Department of China Construction Bank (CCB). Prior to this position, she has been working for the Custody ServicesDepartment at CCB for many years, where she actively participated in the schemes of opening up capital market to foreign institutional investors. She has been sitting on International Business Committee of Asset Management Association of China, and an expert in Chinese stock market infrastructure, mutual fund, custody services and especially QFII program. Ms. Hu has received both Bachelor’s & Master’s Degree in International Finance from the Central University of Finance & Bankingin China.

Mr. Yang Jinzhong, Executive Director of Global Business Development Department, Shanghai Stock Exchange

Yang Jinzhong is the executive director of Global Business Development Department of Shanghai Stock Exchange, member of the 16th Main Board Securities Issuance Appraisal Committee of China Securities Regulatory Commission (CSRC), and advisory member of the Enterprise Accounting Standards Advisory Committee of the Ministry of Finance. He has been working in Shanghai Stock Exchange since 2001, and temporarily worked for CSRC in the areas of regulation of listed companies, system study of domestic listing of overseas companies (the International Board), and IPO appraisal. As leader of the Shanghai-Hong Kong Stock Connect Business Management Group, Yang participated in the entire process of the programme design, rules setting and operations management.

Ms. Alice Li, Head of Partnerships Mainland China, Nuggets

Alice Li is partnership manager for Nuggets, an e-commerce payments and ID platform which stores personal and payment data securely in the blockchain, developing strategic partnerships between the company and technology firms in mainland China. Formerly trained as a linguist, Li will offer her views on the introduction of blockchain in the payments landscape.

Mr. Frank Wang, Managing Director, CreditEase Wealth Management

Prior to join CreditEase, he was a Director of a multi strategy hedge fund ($8B AUM) in NYC. He also worked for Citi Capital Advisor (Citigroup Alternative Investment, with $30B AUM), UBS, etc. Frank has extensive experience in investment management, risk management, asset allocation, portfolio construction, and quantitative analysis. Frank has solid knowledge across asset classes including Equity, Fixed Income, FX, and Structured Products. Frank received his MBA in finance from Haas School of Business in University of California at Berkeley. MS from University of California, BS from Tsinghua University in Beijing China. He is also a CFA charter holder.

Mr. Dai-Kyu Kim, Founder/Principal, Blockonomics.IO

Dai-Kyu Kim is currently Founder/Principal of Blockonomics.IO. A Blockchain Mechanics, Tokenomics and ICO Advisory based in Sydney which guides startups and corporates on Blockchain strategies, business models and ICO fundraisings. Dai-Kyu has invented products, founded companies and worked in IoT, Cryptographic Protocols, Information Security, Digital Imagery, Banking, Brokerage and FinTech for companies such as FASSKey (low level cryptographic authentication protocol), Zylotech (Digital Surveillance), ReMo (IoT Cam concept), Zapr (P2P Protocol), Citibank, NAB, PwC, HP, Hyundai IT, Intuit/Quicken Australia Online (Financial Portal and Online Brokerage) where Dai-Kyu was a co-founder who IPOed the business on the ASX (RKN). Dai-Kyu has worked in Sydney, Melbourne, Seoul, Shanghai, Tokyo, Singapore, HK, KL, USA and France.

Mr. Yuexi Li, Deputy General Manager, Channel and Operations Management Department, China Construction Bank

Yuexi Li is the deputy general manager from the Channel and Operations Management Department at China Construction Bank. Li focuses on research, construction and process innovations for the payments and clearing systems. Li has been working for China Construction Bank for 20 years. He has an MBA from Tsinghua University. Li will share his view on the impact of SWIFT Global Payment Innovation.

Mr. Wang Wen, Chief Economist, China Export & Credit Insurance Corp

Wang Wen is the chief economist, director of Country Risk and Economic Research Department, and director of SinoRating Center of China Export &Credit Insurance Corporation. He is also the professor and PhD supervisor of University of International Business and Economics.

Mr. Vincent Chen, CTO, Financial Services Sector, Enterprise Business Group, Huawei Technologies Co., Ltd.

Vincent Chen joined Huawei in 2014 and now serves as CTO of Financial Industry, Global Sales Division, overseeing the technology & solution sales strategy of the company’s financial sector globally. Mr. Chen has wealth of experience in IT & Banking industry over 20+ years. Prior to joining Huawei, Mr. Chen had a 14 years’ career at Cisco System(China) served as the CTO of South China. Before Cisco, Mr. Chen spent more than 6 years working for Bank of China and in charge of the core banking application development on Mainframe. Mr. Chen hold a Bachelor Degree of Computer Science and a MBA Degree both are all at the Sun Yat-Sen University, China.

Mr. Kiran Bajaj, Senior President, Business and Digital Technology Solutions Group, Yes Bank

Kiran Bajaj is the head of corporate business and digital technology solutions at Yes Bank, leading a unit of techno functional experts responsible for the design and delivery of solutions, meeting diverse requirements across the spectrum of the transaction banking, corporate and institutional banking business. Bajaj has been in the banking sector for 20 years, holding business and technology roles across private sector banks, including Yes Bank and HDFC Bank, and global banks, such as ABN AMRO, RBS, HSBC and Standard Chartered. He covers technology program management and delivery, product development and management, as well as process re-engineering functions delivering solutions.

Mr. Ang Xing Xian, Chief Executive Officer and Co-Founder, CapitalBay

Ang Xing Xian is the chief executive officer and co-founder of CapitalBay, a licensed multi-bank supply chain Finance platform in Malaysia. Prior to founding CapitalBay, he was a management consultant at Accenture, implementing strategies on technology and analytics for many major companies. Before this, he worked for Creador, a private equity firm in Malaysia. Xing Xian also worked for Market Invoice, a trading platform in the UK, and started his career at Credit Suisse, London. He will share his views on the innovations in supply chain finance that are transforming it.

Mr. Xu Ningning, Executive President, China-ASEAN Business Council

Xu Ningning is the executive president of China-ASEAN Business Council. He also serves as executive director of the Ministry of Foreign Affairs, Asia Pacific Centre for China Foundation for International Studies, and the chief Chinese expert of ASEAN Business. He is also a guest professor at the China Foreign Affairs University and University of International Business & Economics, and consultant of China-ASEAN Expo. Xu has published 20 books on economy, such as China-ASEAN Joint Building of Maritime Silk Road, and the China-ASEAN: Cooperation and Development. He has been consistently recognised for his contributions in improving China-ASEAN cooperation in the past two decades.

Mr. Jason Zhengrong Lu, Head & Lead Infrastructure Finance Specialist,Global Infrastructure Facility

Jason Zhengrong Lu joined the Global Infrastructure Facility (GIF) asLead Infrastructure Finance Specialistin 2015 after ten years of working at the Multilateral Investment Guarantee Agency (MIGA) of The World Bank Group. While at MIGA, Luworked on a broad range of complex energy and infrastructure projects worldwide. He has built expertise in managingand closing complex projects and advising clients on infrastructure financing, risk mitigation and credit enhancement to support their investment and financing needs in emerging mark,ets and developing economies.Hestarted his banking career with Bank of America in its Global Project Finance Group where he was responsible for transaction structuring and execution. He also worked at ABB Energy Capital with responsibilities for renewable energy financing in the United States and State Street Bank and Trust Company.

Mr. Shekhar Bhandari, Senior Executive Vice President and Business Head, Global Transaction Banking and Precious Metals, Kotak Mahindra Bank

Shekhar Bhandari is the head of global transaction banking and precious metals at Kotak Mahindra Bank. He is responsible for profit and loss on trade, foreign exchange on flow business, investment and supply chain finance, international trade finance, and domestic and cross border payments. Bhandari has experience in retail and wholesale banking, and has a good track record of creating business impact by building revenue. He has been with Kotak Mahindra Bank for 22 years, playing different roles in various groups within the company such as Kotak Mahindra Finance Ltd, Kotak Mahindra Asset Management Company and Kotak Mahindra Old Mutual Life Insurance.

Mr. Sam Tidswell-Norrish, Principal at Motive Partners & Chief of Staff to UK Prime Minister’s Business Ambassador for FinTech

Mr. Sam Tidswell-Norrish serves as Principal, Business Development at Motive Partners. He is leading Business Development at Motive Partners, and joining with a broad range of financial services experience, from payments to investment banking, and government initiatives to industry trade organizations, as the Chief of staff to UK Prime Minister’s Business Ambassador for Fintech. He began his career with Barclays in Payments Reengineering and subsequently worked in a number of areas of the bank including equity capital markets. He holds broad range of experience in financial services, payments to investment banking and government initiatives to industry trade organizations. He was selected as young leader of the future by the New Entrepreneurs Foundation in 2013.

Ms.Yu Ye, Senior Manager of Payment and Cash Management Head Office, ICBC

Yu Ye is a senior manager from the payments and cash management department of ICBC's Head Office. She joined the bank in 2005 and previously worked in the international department of the head office for the Beijing branch. Ye will share her views on the developments happening in cash management today.

Mr. Boon-Hiong Chan, Director Head of Market Advocacy, Asia Pacific Business Control Unit, Global Transaction Banking, Deutsche Bank AG Singapore

Boon-Hiong Chan serves as the head of Market Advocacy for Global Transaction Banking Asia Pacific at Deutsche Bank AG Singapore. Boon is presently focused on the intersections of new technologies with financial services for implications on legal, regulatory, business models and internal controls. These intersections include blockchain, virtual currencies and data. Prior to that, Boon has held IT system analysis, business strategy, product development and profit and loss management roles in transaction banking products. These products include trade finance, working capital/e-commerce, trust, debt and securitization services and funds and security services. He has about 20 years of experience and started his banking career at Deutsche Bank as a management trainee. Chan will share his view on how compliance and technology are merging to combat financial crime.

Mr. Christian Westerhaus, Managing Director, Global Head of Clearing Products, Cash Management, Global Transaction Banking, Deutsche Bank

Christian Westerhaus is global head of clearing products in cash management at Deutsche Bank. Westerhaus is responsible for product development as well as the strategic planning for the cash management business. He oversees a global team covering USD, EUR, RMB, GBP and multi-currency clearing for a diverse base of clients including commercial, regional, global and central banks as well as broker dealers and asset managers. Prior to this, Westerhaus held a number of senior roles in product management including global co-head of client products and solutions for Global Transaction Banking at Deutsche Bank. He is also an active member of various global and European industry committees, including board member of Euro Banking Association (EBA) Clearing Paris/Brussels. Westerhaus will share his view on the developments transforming cash management that are taking place today.

Mr. Jan Luebke, Head of Market Management, Asia Pacific, Institutional Cash Management, Deutsche Bank

Jan Luebke is the head of Market Management Asia Pacific for Institutional Cash Management at Deutsche Bank. He is responsible for the cash management strategy for financial institutions in the Asia Pacific region, and also involved in the Single European Payments Area and the re-development of Deutsche Bank’s legacy processing and messaging platforms. Luebke has also had a sales position managing foreign bank clients for Deutsche Bank in Germany. In the earlier years of his career, he headed the high-value-payment operations, Quality Assurance Germany in Deutsche Bank, and in this capacity managed the Euro-migration as well as the Y2K challenge. Luebke has 17 years of working experience in operations and transaction banking, and significant regional and global experience across the Americas, Asia and Europe. He will share his view on the trends, initiatives and directives of cross-border payments impacting transaction banking.

Mr. Edward Tse, Author of the books: The China Strategy (2010) and China’s Disruptors (2015)

Edward Tse is founder and chief executive officer (CEO) of Gao Feng Advisory Company. He was formerly chairman of Greater China for Booz & Company and managing partner, for The Boston Consulting Group - China. With over 20 years of experience in management consulting and senior line management, he is widely known as “China’s leading global business strategist.” He has assisted hundreds of corporations – both headquartered in China and outside of China – and public sector organisations on all critical strategy and business issues related to China and its role in the world. His experience covers a broad range of industries and was on the board of three major Chinese state-owned enterprises. He also served as consultant to the World Bank and the Asian Development Bank as well as the Chinese government on policies, state-owned enterprise reform and competitiveness.

Mr. Ricco Zhang, Director, Asia Pacific, International Capital Market Association

Ricco Zhang is the director, Asia Pacific of the International Capital Market Association (ICMA) based in Hong Kong. He is responsible for ICMA’s development in Greater China and works very closely with regulators, financial institutions and other organisations that are active in capital markets in the region to promote and maintain the best market practice. He has previously worked for international law firms, investment banks and other financial institutions engaging in capital market transactions and mergers & acquisitions in Asia, and has extensive experience as a market practitioner.

Mr. Brian W Tang, Managing Director, Asia Capital Markets Institute

Brian W Tang is the founder and managing director of the Asia Capital Markets Institute (ACMI), a platform for global thought leadership, industry-wide consensus building, and transformational technology. ACMI’s areas of focus include regulatory technology (RegTech), online capital marketplaces and artificial intelligence. Tang is also co-chairs the RegTech Committee of the Fintech Association of Hong Kong and the IEEE AI Ethics Initiative’s Policy Panel. He is one of the instructors of Asia’s first massive open online course on financial technology designed by the University of Hong Kong (HKU) for EdX. He is a corporate finance lawyer who has worked on Wall Street, in Silicon Valley and in Hong Kong on financing technological innovations. He previously worked at global investment bank Credit Suisse in Hong Kong, Sullivan & Cromwell in New York and in California, and Mallesons in Perth, Australia.

Mr. Silawat Santivisat, Executive Vice President, Kasikornbank

Silawat Santivisat is executive vice president at Kasikornbank, which will be awarded The Best Cash Management Bank in Thailand by The Asian Banker. Santivisat has 28 years of experience as corporate head with a demonstrated history of working in the banking industry and corporate world. He has skills in innovation, product management, business process, operations management, risk management, banking, and business development. He will share his views on how will blockchain tokenisation become the game changer of transaction banking.

Mr. Adinata Widia, Senior Vice President Transaction Banking Wholesale Product Group, Bank Mandiri

Adinata Widia is the senior vice president of transaction banking Wholesale Product Group head at Bank Mandiri, managing transaction banking business in fee based income, interest income as well as achieving current account average balance. Widia joined Bank Mandiri on 2014 as senior vice president transaction banking sales group head. Prior to that, he was senior vice president cash management head at Bank Danamon for five years. With more than 20 years of experience, he also worked at CIMB Niaga, Lippobank, Citigroup, and Citibank Indonesia and Philippines. In this conference, he will share his views on the developments that supply chain finance and logistics are experiencing.

Mr. Wu Kedi, Vice President, Neo Online (Neo Capital)

With 11 years of experience in the financial sector, as a large securities trader and working with a well-known trust company, Mr. Wu has gathered a vast amount of experience in areas such as M&A, investment, fund-raising and asset restructuring. Mr. Wu used to work as a principal at Zhonghai Trust, and is thus very well versed in the fields of industrial trust, M&A trust, and financing trust. He also participated in the design of the first Chinese M&A fund for the logistics industry, and boasts wide managerial experience, excellent understanding of modern product technology and outstanding team leadership skills.

Dr. Shirley Yu, Financial Media Personality

Dr. Shirley Yu earned her PhD in political economy from China’s Peking University, and her Master’s degree in government from Harvard University. She is the Chief Strategic Officer and Vice President of Xin Yuan Group Co. Ltd. Dr. Yu began her career in investment banking with Merrill Lynch. She subsequently returned to China asnews anchor onCCTVNews. She has beena frequent speaker and moderator of dialogues with global icons, including the likes of Alan Greenspan, Larry Summers, former Prime MinistersDavid Cameron, Bob Hawke, Paul Keating, among other heads of states, governments and global influencers. Shirley is also the author of three books in Chinese, 《无欲自芳菲》(Fearless Pursuit)and <百国大使谈中国》(On China, by Ambassadors), and the most recently released 《人民币崛起及日元之殇》(The Rise of the RMB and the Fall of the Yen.)

Mr Zhang Xia, Principal Enterprise Evangelist, Greater China, Amazon Web Services

Dr. Zhang is Greater China’s Enterprise Strategist and Evangelist at Amazon Web Services, focusing on promoting cloud technology for enterprise business innovation and technology transformation throughout PRC, Hong Kong SAR, and Taiwan. Dr. Zhang has more than 20 years of experience in IT developmentboth in the USA and China. He brings extensive experience in the fields of cloud computing, mobile, social, AI/ML and big data. Dr. Zhang has held a variety of leadership roles, including CTO for Retail Banking for Bank of China in 2002-2006. Dr. Zhang also held the position of CIO of FordDirect in 2000-2002. This experience gives him deep expertise in the critical role technology plays in business transformation, and helped him to hone skills in cutting-edge areas like solution architecture, data and analytics, customer engagement marketing, e-commerce operations and more.

Ms Fangfang Jiang, Senior Operations Officer, Financial Institutions Group

FangFang oversees financial inclusion work in China, covering policy advocacy, sector level knowledge sharing and capacity building to individual firms/financial institutions, with a special focus on microfinance, SME, digital finance and rural finance. Before joining IFC in 2012, she served as the Head of MSE Department in a leading commercial bank in China, and engaged in the strategic development, product innovation, risk management and staff training for a MSE line covering 30 branches in 5 different provinces with 300 staff. From 2005 to 2010, she worked in International Project Consulting Company and introduced the commercial microfinance model to China, through World Bank-China Development Bank Microfinance Project, and provided capacity building to seven city commercial banks in China to help them build up MSE business lines from scratch. Fangfang Jiang graduated from Sichuan University in China with a Bachelor Degree in foreign trade, and obtained an M.A and MBA degree in Bremen University of Applied Science in Germany.

Dr Dan Wang, Secretary General, China Association of Microfinance

In 2000 Dr Dan started to engage in the management of microfinance projects of the UNDP when she worked at the foreign aid project office of Sichuan Department of Commerce. In 2005, she returned from Australia and joined the setup of China Association of Microfinance. Since then she has been managing the secretariat and also providing credit risk management, disaster management, human resource management, staff incentive mechanism, social performance management, client protection and other training courses as well as client protection assessment services for the member institutions. During the period, she also participated in the microfinance training and consulting projects organized by the World Bank Institute, ADB, UNDP, IFAD, IFC, KFW and other international agencies.

Ms Ellis Odynn, Executive Director, Digital Finance Institute

Ellis Odynn champions the title of Canada's first Chief AI Officer. She was recently appointed as the Executive Director of the Digital Finance Institute (DFI). In this capacity, she heads the DFI’s Artificial Intelligence division and research team. Her responsibilities span many of the institute’s key initiativesfrom building partnerships, conducting outreach and managing international affairs. Ellis has fully immersed herself in the tech world and is also the manager of Einstein Exchange's Toronto Office. Speaking at events and conferences on the topics of AI, Blockchain, FinTech, Financial Crime, Digital Currencies and Regulation has become an outlet for sharing her knowledge and passion.When she isn’t uniting the AI industry, Ellis dedicates her time to running a charitable organization that brings education, security and inclusion to refugee girls in Africa and the Middle East.

Mr Peter Gubarevich, Ethical Hacker & Systems Architect, JSC OlainFarm, Latvia

Peter is an experienced IT Pro / IT Security specialist. He holds multiple MCSE/MCITP/CEH certificates. He also conducts Windows Server and Ethical Hacking trainings across Europe, and is a frequent contributor to various ITSec conferences and projects Having many years of hacking experience, Peter currently provides IT Security services for regulated pharmaceutical and financial environments.

Mr Wan Zulhamli bin Wan Abdul Rahman, Head of Strategic Research and Advisory department, CyberSecurity Malaysia, under the Ministry of Science, Technology and Innovation (MOSTI)

Wan Zulhamli has 13 years of experience working in IT incident management and organization strategic planning in various industries including oil and gas, system integration as well as semi-government organisation. He is now the Head of Strategic Research and Advisory Department for CyberSecurity Malaysia. He leads a team in providing strategic input and advice to management related to cyber security information, analysis on cyber threats, mitigation strategies, recommendations and best practices for known and emerging threats; which to assist the management to make well-informed decisions. He’s also working closely with National Cyber Security Agency (NACSA) Malaysia in term of strategic collaboration and government initiative focusing on people, process and technology. Apart from NACSA, Wan Zulhamli engages with numbers of government agencies, higher learning institutions and NGOs to ensure he gets bird’s eye view related to cyber security; not limited to technology vulnerabilities, existing threats, potential attacks,incidents response, and awareness as well as bridging programmes to fill the gap.

Ms Hou Lin, Senior Vice President, CreditEase and General Manager, Product Department, CreditEase Wealth Management

Ms. Lin Hou is the General Manager of Wealth Management Product, CreditEase, and leads the financial product teams in Beijing, Shanghai, HK, Singapore and other places and is in charge of the design and introduction of CreditEase innovative financial products and services. As one of the founding members of CreditEase, she has participated in the design, incubation andgrowth of the company during the past 12 years, and, from an early stage, beenfocusing on investment and wealth management industries, entrepreneurship, and the innovation of financial investment products. Ms. Lin Hou received her Masters Degree in Law from the School of Law, Peking University.

Mr Daniel Hu, Head of corporate Banking, Greater China, Barclays

Daniel Hu, who has over 25 years of experience in banking, is the head of corporate banking, Greater China, at Barclays. He joined Barclays in November 2017 from JP Morgan in China, where he led the coverage and product teams, serving the corporate banking needs of Chinese corporates. Prior to JP Morgan, Hu worked for Citibank, ABN Amro and Standard Chartered,in their Shanghai, Beijing and Hong Kong branches. Hu will share his views on the trends and initiatives affecting global transaction banking as well as financial services that facilitate global trade.

Mr David Chance, Senior Executive, Payments Strategy, Fiserv

David Chance is a senior executive for payments strategy at Fiserv. He has led the company’s strategy, solutions and technology initiatives to drive innovation across the payments landscape, including card, retail, wholesale, corporate and instant payments. As part of the Dovetail’s executive leadership team, Chance has led the product development and strategy for the recently acquired universal payments company, Dovetail. His experience includes senior roles at eFunds in corporate cash management, middleware and real-time payments, including supporting financial institutions in strategic planning for UK Faster Payments. In this conference, Chance will offer his view on the future of cross-border payments industry.

Ms Xingfei Chen, Head of Transaction Banking Department, China Guangfa Bank (HQ)

Xingfei Chen is the head of Transaction Banking Department at the headquarters of China Guangfa Bank (CGB). She has experience on international Letters of Credit (LC) and factoring, as well as international and domestic settlement, trade finance, in both onshore and offshore, and cash management business. She has been responsible for the development and system construction in cash management and trade finance product for a long time. Chen holds a senior economist title. In this conference, she will share her views on the key trends in real cash management.

Mr Jame DiBiasio, Co-Founder & Editor, DigFin Group

Jame DiBiasio has been a financial journalist since 1995. He arrived from New York with Institutional Investor News, founded AsianInvestor magazine in 2000, and served as editorial director at Haymarket Financial Media, overseeing AsianInvestor, FinanceAsia and The Corporate Treasurer.

Mr Alex Medana, Co-Founder & CEO FinFabrik

Alex is the CEO of FinFabrik a HK-based FinTech company building the next generation of platforms to improve the customer journey particularly in capital markets and wealth management. He is also a Board Member Fintech Association HK. Previously, Medana spent 17 years in various tier 1 global financial institutions overseeing operations across diverse asset classes, client segments and business lines in Europe and APAC.

Mr Daniel Gusev, Managing Partner, Gauss Ventures and Russian FinTech Association Envoy

Daniel Gusev is a seasoned entrepreneur in financial services innovation space, starting and chairing several successful labs and design-driven project offices in leading banks in CEE, Europe and the UK since 2009. He is a mentor with several accelerators in the UK, Hong Kong and New Zealand, reads lectures for Imperial College London Fintech Program and advises several international start-ups. He has also contributed in various founder and executive roles to 3 startups and had experienced the joy of 1 exit. Daniel graduated from Moscow State University with a degree in History and did postgraduate studies in Banking with Financial University

Mr Jackal Ma, Co-Founder & Partner, Tongdun Technology

Co-Founded Tongdun Technology (formerly known as Fraudmetrix), pioneering in application of Big Data technology into daily business with his “Cross Industry Joint Defense” concept. He has 30 years working experience covering North America, Australia, Asia and Europe. Seasoned technology and business executive in Asia, with previous experience including. Advisor and consultant at various business/technology transformation initiatives such as Citibank, HSBC, Standard Chartered, PingAn Insurance, China Construction Bank and Pudong Development Bank. Appointed as Advisory consultant for various country level initiatives in China including Ministry of Industry and Information Technology, National Development and Reform Committee. Born in Hong Kong, with a Bachelor degree in Electrical and Electronic Engineering from University of Hong Kong, and an Executive MBA degree from China’s Top Business School Chang Kong Graduate School of Business.

Mr Jackson Cheung, CEO & Co-founder, Youxin Financial

Jackson Cheung founded Youxin Financial and launched Renrendai, its flagship product, in 2010. Renrendai is a leading online peer-to-peer lending company in China, connecting individual investors and borrowers. As of March 31, 2018, Renrendai has facilitated cumulative transaction volume of over ¥54 billion and has earned over ¥4.7 billion for investors on the platform. Cheung was included in Forbes China’s “30 Under 30” in 2014, a select list of Chinese young entrepreneurs and innovators who are making an impact in the world; and in Fortune magazine's “40 Under 40” in China in the same year. In 2016, he was awarded the "Internet Finance Figure of 2016" by Securities Times.

Ms Andra Sonea, Former - Lead Solutions Architect, Innovation & Digital Development Directorate, Lloyds Banking Group, UK

Andra splits her time between consulting internationally with 11:FS and doing research at the University of Warwick, UK. Her research interest is in the modularisation of the financial services architecture and the development of new large-scale systems as complex adaptive systems. Andra built her career in consulting mostly with IBM and SAP and has worked internationally implementing complex financial systems for large corporations and banks. For the past seven years she has been involved in the Fintech market in London, setting up a Business Innovation Lab in IBM. Prior, she was lead solutions architect with the Innovation & Digital Development Directorate at Lloyds Banking Group in London where she is focusing on building the next generation data analytics platform, collaborating with start-ups and monitoring the global FinTech scene. As part of her role she conducts well-structured experiments that answer important business questions.

Mr Aidil Zulkifli, CEO & Co-Founder, UangTeman

Aidil is a technoprenuer with a great interest in the Fintech sector. In late 2014, together with his co-founder, he founded UangTeman.com, the first online short-term loan service provider in Indonesia. UangTeman helps Indonesians to access small, short-term loans for individuals to meet their needs such as medical bills, school fees and more. Prior to the founding of UangTeman, Aidil worked as a commercial lawyer at Duane Morris & Selvam LLP. His first fintech startup, KreditAja.com and LoanGarage.com, was acquired by Moneysmart.sg in late 2014. Aidil divides his time between Indonesia and Singapore, the two markets that he is extremely familiar with. He is also an active advisor for early start-ups.

Mr Navin Gupta, Managing Director, South Asia & MENA, at Ripple

Navin Gupta is Managing Director, South Asia & MENA, at Ripple. Navin has extensive experience in global transaction banking, payments and cash management, and strategy planning following nearly two decades working for HSBC (2005-15) and Citigroup (2001-05) across the U.S., Hong Kong, Japan, Taiwan, and India. During his tenure (2007-09) as Head of Payments and Cash Management for HSBC Japan, the business was transformed and voted the #1 Cash Management Bank in Japan. He was also a chief architect of HSBC’s global initiative on Working Capital and Liquidity Management and in 2008 was recognized as one of "The 50 Most Promising Young Leaders" in Asia Pacific by The Asian Banker. Prior to joining HSBC, Navin spent close to five years at Citigroup in San Francisco as a global relationship manager for technology, media and telecommunications clients. Navin was a board member of National Payments Corporation of India (NPCI) between 2011-2014, advising on Payments and Cash Management

Ms Heike Winter, Director, Retail Payments Policy, Deutsche Bundesbank

At the Deutsche Bundesbank, Heike Winter is responsible for policy issues relating to the retail payment system. This comprises committee work in the Euro system and in the German banking industry as well as designing the Bundesbank’s range of services for credit institutions. After completing her degree in economics, Dr Winter worked at an institute for economic theory. She joined the Deutsche Bundesbank in February 1999, working initially in the Public Relations and Economic Education Departments before transferring to the Payments Department in March 2007.

Mr Chengyun Chu, CEO and Co-Founder, C2SEC

Chengyun Chu is the CEO and Co-Founder of C2SEC, a startup focusing on predicting and quantifying cyber risk in financial terms. Before founding C2SEC, Chengyun worked as Director of Cyber Security Strategy of Microsoft. He leads the efforts to build various successful security products and services from the ground, such as EMET and Office 365 Advanced Threat Protection. He also led Microsoft Security Response Center (MSRC)'s engineering team to respond to high profile security incidents such as Stuxnet, Aurora, and Flame.

Ms Han Ying, Policy Director, United States Information Technology Office (USITO)

She currently heads up the Cybersecurity Working Group and leads the Emerging Technology Initiative. She is specialized in cybersecurity, data, privacy, and encryption related policies. In her role, she extensively works with world leading technology companies, has a profound understanding of the policy issues, and proactively engages with policy makers to communicate industry voice and help improve policy outcome. Han Ying has extensive experience in ICT sector from her previous position as a Trade Commissioner covering ICT and Digital Media sector in Embassy of Canada, in her role at the Canadian Embassy, she counseled Canadian ICT and Digital Media companies on China ICT policy and market in China, helping them develop competitive business strategy.

Mr Wang Jicheng, Deputy General Manager, Kaixin Financial

Wang Jicheng, deputy general manager of Kaixin Financial Service Co. Ltd, graduated from Nanjing University computer science school, with a PhD degree and served as associate professor after graduation. In 2012, he was involved in building Kaixin Financial Service Co. Ltd, mainly responsible for the company's technology development based on the company strategy and market demand, the formation of technology team, and product optimization. He also led the research and development of the IT project of P2P and Asset Trading Platform and supported the company's strategic development and product innovation.Prior to that, he was with world's leading network security service provider, Trend Technology, as project director, whichaccounted for his rich experience in system research and development and information security .

Mr Yao Huiya, Head, FinTech Innovation, WeBank (Tencent)

Yao Huiya is a veteran of fintech and internet finance, with deep insight and profound thinking of retail banking transformation in the new tide of internet plus.Yao is currently the Head of FinTech Innovation at WeBank, and the Deputy Secretary General of Financial Blockchain Shenzhen Consortium (FISCO).Prior to joining WeBank, he held a variety of senior positions at a number of financial institutions, including Head of Channels and Cards Technology at Citibank China, Head of Technology and Operation Service Management at UOB China, Deputy GM and Director of Operation and Technology at a financial holding company.

Mr Vladislav Solodkiy, Managing Partner, Life.Sreda and CEO, Arival Bank

Solodkiy was recognised by UK magazine Institutional Investor as one of the TOP35 most influential fintech-persons in the world. He established Life. SREDA four years ago, which has invested in 22 start-ups in US, UK, Germany, CIS, Singapore, Philippines, India and Vietnam, including Simple, Moven, Fidor Bank, SumUp, Anthemis Group, Mobikon, and Lenddo. For the last one and a half years, the company heavily supported the fintech ecosystem in Singapore. It invested in eight companies; launched Inspir Asia co-working space and accelerator; and helped the Monetary Authority of Singapore in promoting Singapore as fintech hub across the world by launching www.BAAS.IS, the first pan-Asian bank-as-a-service-platform.

Ms Ghela Boskovich, Head of Fintech,Rainmaking Innovation

Ghela is active in the fintech industry, having spent the last ten years focused on business development for core insurance and banking system solutions, the last half of which has centered on financial services pricing governance functionality. Ghela also founded FemTechGlobal to bridge the gender gap in fintech and the financial services industry and was named one of Brummell Magazine’s 2016 ‘30 Inspirational Women Innovators’ and included in Innovate Finance’s Women in Fintech Powerlist 2016 & 2017.She also sits on the Banking Technology Awards judging panel and sponsors the Banking Technology Women In Technology (W.I.T.) Award, as well as the board of the Financial Inclusion Institute.Ghela is MD of Fintech/Regtech Partnerships at Rainmaking Innovation, home of Startupbootcamp.

Mr Ming Zhao, Professor, School of Computing, Informatics and Decision Systems, Arizona State University, USA

Ming Zhao is a professor of the ASU School of Computing, Informatics, and Decision Systems Engineering. Before joining ASU, he was an associate professor of the School of Computing and Information Sciences (SCIS) at Florida International University. He directs the Research Laboratory for Virtualized Infrastructure, Systems, and Applications (VISA). His expertise and interests are in distributed/cloud computing, big data, high-performance computing, autonomic computing, virtualization, storage systems and operating systems. He was awarded a National Science Foundation (NSF) Faculty Early Career Development (CAREER) Award in 2013 and he received the ASEE Air Force Summer Faculty Fellowship in 2013, the VMware Faculty Award in 2014, the FIU SCIS Excellence in Mentoring award, the FIU SCIS Excellence in Research award. He received his Ph.D. in electrical and computer engineering from the University of Florida, and his Bachelor and master’s degrees in automation/pattern recognition and intelligent systems from Tsinghua University.

Mr Ayumi Konishi, Special Senior Advisor to the President, Asian Development Bank

Ayumi Konishi is special senior advisor to the president of the Asian Development Bank (ADB). Prior to this, he was director general of ADB’s East Asia Department between 2013-2017. Konishi joined ADB in 1988. During the Asian Financial Crisis, he was the task manager for an ADB crisis support loan for Thailand, and subsequently coordinated ADB support to Indonesia. He was ADB Country Director for Viet Nam between 2006-2011. Prior to joining ADB, he served for the United Nations in Baghdad, Iraq (Economic Commission for Western Asia), New York (Secretariat), and Addis Ababa, Ethiopia (Economic Commission for Africa).

Mr Cao Yuanzheng, Chairman, BOCI Research

Cao Yuanzheng is the chairman of BOCI Research and International Economist. He also holds other prestigious positions like co-dean of China-EU Lujiazui International Financial Research Institute, professor and doctoral tutor of Renmin University, visiting professor of the University of Southern California, as well as vice president of China’s macro-economic society and member of China Economics Forum. He was previously the director of Scientific Research Department at China Institute of Economic Reform, director of Comparative Economic Division of Foreign Economic Division, and deputy director of Institute of Economic and Management. He also served at the World Bank, the Asian Development Bank, and the United Nations Development Program and at Bank of China.

Mr HwaErh-Cheng, Chief Economist, Baoshang Bank

HwaErh-Cheng is chief economist at Baoshang Bank. Prior to this he served as chief economist at China Construction Bank, as well as in several departments of World Bank including the residence mission office in China, and economist at the International Monetary Fund. Earlier he pioneered research of a monthly econometric model of the US economy at Cornell University and the national bureau of economic research. He also served as chairman of Wuxi and Qunshang high-tech science park, advisor for the governor of China’s Guangdong province, and taught at Peking University, Beijing Normal University and Shih-Hsin University as visiting professor.

Mr Jackson Xu, Head of Regional Treasury, Sanofi Asia JPAC

Jackson Xu is the head of regional treasury at Sanofi Asia Japan and Asia Pacific (JPAC), where he is responsible for overseeing the cash management, cash flow forecast and liquidity, FX risk management and control, financing, investment, credit risk management, trade finance, M&A, bank guarantees, corporate bond, corporate card, and insurance management operations of the company invarious countries and regions. Prior to that, he was regional treasurer at Alstom Corporate Treasury and he also worked at China Construction Bank. He has more than 20 years of experience in treasury management.

Mr Richard Jones, Business Development Director, AIIB-EBRD

Richard Jones is business development director at The Asian Infrastructure Investment Bank - The European Bank for Reconstruction and Development (AIIB-EBRD)and has been on secondment from the EBRD to the AIIB in Beijing since October 2017. He is responsible for EBRD’s business development with AIIB, Chinese financial institutions and companies investing in EBRD’s region of operations. Jones joined the EBRD in 2003 after working at the UK Treasury and the European Commission. He has also handled various positions at the EBRD, most recently as interim director of the President’s Office and head of the Dushanbe Resident Office, Tajikistan.

Mr David Brearley, Head of Consulting, Silverlake Group

David Brearley is currently working with Silverlake, on the development of innovative software architectures to enable banks to compete in the Digital Economy. Brearley has spent 45 years in consulting and senior management positions in financial services world-wide, including 18 years as a CIO. In 1988 he was appointed the first Group Head (CIO) of Standard Chartered Bank. In the last fifteen years, David has focused on practice areas of Business Transformation, IT Strategy and Enterprise Architecture working particularly with large local bank CEOs, COOs and CIOs in Malaysia, Singapore and Thailand. He has also worked on the early stage development of software businesses in search, middleware and omni-channel services.

Mr Zong Liang, Lead Researcher, Bank of China

Zong Liang currently serves as lead researcher of Bank of China. In the past few years, Zong has been involved in more than ten research projects initiated by various international institutions and ministries. He published more than 200 papers including “Renminbi‘s Going Global and the Prediction”, “The Changes in Regulation After Recession” and “Risk Management in Cross Region Banks”. Zong was also part of the PHD service group and mayor’s assistant at Fuzhou, Jiang Su Province.

Ms. Neeti Aggarwal, Senior Research Manager, The Asian Banker

Neeti Aggarwal heads the technology research practice at The Asian Banker. With over 14 years experience in research and publication industry, she specialises in banking research and technology developments across Asia-Pacific, Middle East and Africa. She earlier worked for five years at The Economic Times, India’s largest selling financial daily. Aggarwal is a CFA Charterholder from CFA Institute USA, and an MBA (Finance) from India.

Mr. Foo Boon Ping, Managing Editor, The Asian Banker

Boon Ping manages The Asian Banker publication business and engages practitioners, customers, partners and the media on critical issues that impact the industry. He has more than 19 years of experience in the banking and financial services industry, specializing in strategic branding, marketing communications and consumer insight. Prior to The Asian Banker, he was at United Overseas Bank (UOB), covering Singapore and key markets in the region, such as China, Indonesia, Malaysia and Thailand.

Emmanuel Daniel,Chairman, The Asian Banker

Founder of The Asian Banker, the most respected provider of consulting and intelligence in the financial services industry in the Asia Pacific region and other emerging markets. Mr Daniel has led it to become a combination of leading industry research, publication and consulting house, with a strong reputation worldwide.

Richard Hartung ,International Resource Director, The Asian Banker

Mr. Richard Hartung has over 20 years of experience in the payments & consumer financial services industry. He has held senior roles for financial institutions including Citibank, Mastercard International, and OCBC Cards. Mr Hartung holds position as consultant in the areas of retail banking, cards and payment products to financial institutions, service providers, and software companies throughout the Asia Pacific region.

Mathew Welch,International Resource Director, The Asian Banker

Mathew Welch has spent over 25 years in financial services in Asia. His experience covers a wide range of areas including investment / wholesale banking, asset management and PE investments. Previously, Welch worked as managing director and head of financial institutions group Asia at ING, and as global head of banks & financial institutions head of Asia for Standard Chartered Bank (SCB). Working in SCB, he grew the FI revenues of the bank for more than fivefold in a four year period, adding more than US$1bln to revenues and creating one of Asia’s largest FI businesses.

Bill Chua,International Resource Director, The Asian Banker

Bill Chua was former MD and head of global financial institutions group, UOB, managing relationships with banks, non-bank financial institutions, supra-nationals, sovereigns and sovereign entities. In his 34 years of experience in the financial services industry, he has covered institutional wholesale and consumer banking in the front, middle and back offices. Prior to joining UOB in 2000, Chua was with Citibank for 20 years. He serves as a director for several UOB-owned companies and/or joint ventures, and is also an active member of the financial and education communities in Singapore.

Mr. Gordian Gaeta, International Resource Director, The Asian Banker

Gordian Gaeta has been a banking consultant for some 25 years. He has advised and served many of the leading financial services organisations across Asia and close to half of the top 100 banks worldwide. He specialises in developing and implementing analytical solutions for complex strategic issues in financial services-related industries undergoing significant change or being exposed to intricate risk issues.

Mr. Urs Bolt, Fintech & Regtech Expert

Bolt has more than 25 years’ experience as a senior banker working in the financial services industry, most recently at Credit Suisse. He focuses now on wealth management, investment banking, risk & regulation, and financial technology business. His expertise centres on developing and launching new digital business platforms and establishing prime services for high net-worth/ultra-high-net worth clients. His focus is to help financial technology (fintech) and regulatory technology companies and financial service providers review/refocus business strategies, develop products and markets, execute sales, scout for fintech solutions and start-ups, build business partnerships, and implement corporate structures and processes.

Sir Tim Berners-Lee , Inventor of the World Wide Web, leader & visionary in the future of technology and founder, Open Data Institute

One of the world's "Most Influential Thinkers,” Sir Tim Berners-Lee created the most powerful communication medium in the world — the World Wide Web — and gave it to the world for free. It is no exaggeration to say that his visionary work has transformed every aspect of our lives. Sir Tim’s genius is in understanding the next, new unimagined future and practical consequences for business, technology and how it will transform the way we live and work, the way we govern, and much, much more. Sir Tim will share his insights about the future of finance and blockchain with audiences who learn how to apply new technologies now for competitive advantage or thoughtful consideration about the future we want to create.

Mr Roeland van Zeijst, Global cyber security strategist, RovaZ.com and Former, Digital Crime Officer, Interpol, Singapore

Roeland van Zeijst is a global speaker on cyber security strategiest, he draws on various backgrounds, having experienced working in international law enforcement, mass media management and internet connectivity. In the 1990s, Roeland founded the first direct-access internet provider in the Netherlands. His country was the first to connect to the internet outside of the United States, spawning a vast industry that is still leading today. Prior, Roeland worked as an award-winning presenter on Dutch national radio, while simultaneously studying the field of Artificial Intelligence. He played a key part in implementing the national interactive civilian’s alert network Burgernet. From 2015 to 2017, Mr. Van Zeijst facilitated the development of INTERPOL’s Cyber Fusion Centre in Singapore. He has published several articles on hot topics in cyber security in English, Dutch and German.

Mr Ricardo Gonçalves, Head of APAC Intelligence, Barclays Group Chief Security Office

Ricardo has more than 17 years experiencing directing and implementing IT, Information Security and Cyber Threat Intelligence solutions within large scale. He is expert in Cyber Threat Intelligence, Cybercrime / Cyber Fraud, Threat Management, Security Automation / Orchestration, Network and System Security and Solution Architecture. Ricardo joined Barclays in 2017 to head their APAC security intelligence efforts. Before that, Ricardo worked for the last 3.5 years with Commonwealth Bank of Australia shaping the internal cyber intelligence function and working next to the IR and Cybercrime teams. His tasks would range from executive communication to dissecting malware web-injects. A key aspect of his role was the creation of a solid (and fruitful) network between law enforcement, industry peers, and internal business stakeholders.

Mr Ben Chisell, Product Director, Starling Bank

As Starling Bank’s product director, Chisell jointly manages the product and design team, using data to improve the relationship between customers and their money, and to help the business make better decisions. Chisell was previously product lead for Amazon Videoand is keen to bring their brand of customer obsession to Starling. He spent four years in London and California leading the development of eBay’s search engine and its first steps into machine-learning. After working for large, US-headquartered tech companies, he joined Starling because he wanted to solve problems that could have a meaningful impact on people’s lives, and to help develop an exciting new tech brand in London from the ground up.

Mr Jakub Zakrzewski, International Expansion GM, Revolut

Jakub Zakrzewski is currently responsible for the Asia market expansion for Revolut and the continuance of growth in the global market. Before Revolut, Zakrzewski was head of growth at Easyship, a 500-Start-up VC portfolio company. Prior to joining Easyship, Zakrzewski worked at Lazada (Rocket Internet’s most successful venture up to date, acquired by Alibaba for $1 billion+ in 2016) as a global venture development manager in Singapore, where he established business intelligence and online marketing departments at the company.

Mr Alain Falys, Chairman & Co-Founder, Yoyo Wallet

Alain is a serial technology entrepreneur and investor. He is currently chairman of London-based Yoyo, Europe's fastest growing mobile payment and loyalty marketing platform, which he co-founded with Michael Rolph and David Nicholson in 2014. Alain is also a Partner at Firestartr.co, the tech startup investment platform, a Venture Partner at Touchstone Innovations Plc and a Director at Pelican.ai and OneLinq.nl. Previously, he co-founded the OB10 global e-invoicing network, which floated in London as Tungsten Corporation Plc. He was Senior Vice President at Visa International and co-founded Omnis Mundi, an e-commerce incubator with operations in Frankfurt, Berlin and Zurich, with successful startups such as BuyVip sold to Amazon in 2010.

Mr Kartik Athreya, Executive Vice President & Director of Research, U.S. Federal Reserve Bank of Richmond

Kartik Athreya was appointed executive vice president and director of research of the Federal Reserve Bank of Richmond on 1st April, 2015.In this role, Athreya leads economic research efforts at the Richmond Fed and advises the bank’s president on matters related to monetary policy, banking and financial markets. He also serves as a member of the senior leadership team.Athreya joined the Richmond Fed in 2000 as an economist, was promoted in 2005 to senior economist, and then in 2010 to research advisor, focusing on macroeconomics and household finance. He was appointed group vice president of microeconomics and research communications in 2012.His work has been published in numerous economics and academic journals and he is the author of “Big Ideas in Macroeconomics: A Nontechnical View”, published by The MIT Press in 2013.

Mr Ned Phillips, Founder and CEO, Bambu

Ned Phillips, former managing director and now entrepreneur, is the founder and chief executive officer of Bambu. He has been in Asia for the past 25 years; starting his journey in financial technology (fintech) since 1999 with E*TRADE as one of the very first online brokers before becoming managing director in 2007. He was part of the transformation of the stock exchange where he developed two pan-Asian exchanges. Phillips was appointed as a consultant to 8 Securities when they launched the first robo-advisor in Asia. He built a solution for various sectors that lead to the birth of Bambu.

Mr John Wong, Head of Global Liquidity & Cash Management, Hang Sang Bank Limited

John Wong has 28 years of experience in transaction banking, covering sales, product management, digital banking channel development and client implementation. He is currently responsible for Hang Seng Bank’s strategy across. He has spent his career on banking in Hong Kong, China and across Asia Pacific. Before joining Hang Seng Bank in 2015, Wong spent 25 years with Standard Chartered Hong Kong.

Mr Stéphan Levieux, Head of Deposit, Payments and Cash Management Strategy, Hang Seng Bank

Levieux is responsible for the bank’s strategy for its deposit, payments and cash management business. His work has a particular emphasis on the bank’s proposition for its corporate, commercial and institutional customers. Prior to joining Hang Seng Bank in 2014, Levieux spent 16 years with HSBC in Hong Kong. His last position with HSBC was as the Asia Pacific head of product management for the bank’s payments and cash management business. Before specialising in transaction banking, Levieux also held roles in information technology and in relationship management with Banque Nationale de Paris in Hong Kong. He was a member of the Payments Market Practice Group, representing Hong Kong from 2011 to 2014 and the Payments Maintenance Working Group since 2016. He chairs the SWIFT National Member and User Group in Hong Kong since 2013.

Mr Zhou Zhihan, CEO, Kaixin Financial Service Co. Ltd

Zhou Zhihan is the chief executive officer of Kaixin Financial Service and its subsidiary,Jiangsu Kai JinInternet Financial Asset Trading Center Co. Ltd (Kaijin Centre). Kaijin Centre offers research and development of financial innovation products and technical services related to Internet finance. Since December 2011, Zhou has been engaged in the preparation of the Kaixindai model, which reduces the total cost of small and medium enterprises by using internet technology, as the director of the lead departments at the Jiangsu Branch of China Development Bank (CDB). Prior to that, Zhou worked in the Jiangsu Branch of CDB, focusing on the innovation of small and micro financial services. Zhou is also a senior economist who will share his vision on the key developments in supply chain finance under a complex payment network.

Ms Jovilyn Cotio, Supply Chain Finance Consultant, Asian Development Bank (ADB)

Cotio works with corporates and financial institutions to deliver supply chain finance solutions to small and medium-sized enterprises in developing Asia. Prior to joining ADB, she worked across varied roles in different industries including sourcing and people relations for a manufacturing start-up, credit management and business planning for a Japanese bank.

Mr Saket Modi,, CEO & Co-founder, Lucideus & notorious hacker

Saket is the CEO & Co-founder of Lucideus Inc., a cyber security platform and services company. Hestarted Lucideus in 2012. Over the last 5 years, he and his team has beeninstrumental in providing digital risk management services to multipleFortune 500 companies across the globe. Saket has been widely covered by media across the globe, some names include BBC, CNN, CNBC, The Washington Post, The Economic Times, Mintand more.

Mr. Rani Sweis, Ex-Googler & Creative Director, Attic Salt

Mr. Amol Bahuguna, Head of Payments and Cash Management, Commercial Bank of Dubai

Amol Bahuguna is the head of payments and cash management at Commercial Bank of Dubai. He has over 22 years of experience in diversified industry verticals, including wholesale banking and delivering significant growth in payments and cash management business across diverse customer segments through financial facilitation, advisory and efficient operational execution. Bahuguna has extensive knowledge in delivering cash management solutions across South Asia and Middle East, and has worked with local and international banks. He joined Commercial Bank of Dubai in 2015, leading of several initiatives, including UAE's first Treasury and Cash Management Best Practice Handbook. In this conference, he will share his views on the cash management developments today and where they will lead the industry.

Mr. Gurumurthy Palani, Global Transaction Banking Head, Wholesale Banking, Gulf International Bank

Mr. Stéphane Nappo, Global Chief Information Security Officer & Board advisor, Société Générale

Stéphane has over 20 years’ experience in cybersecurity information, threat intelligence and cyber-crisis management. Mr. Nappo is the Global Chief Information Security Officer & Board advisor at Société Générale IBFS for more than 7 years where he is responsible of development of Cybersecurity and IT Risk Management for International Services in Europe, Russia, South America and Africa/Asia/Mediterranean Basin & Overseas where his responsibilities includes security Governance, risks management and continuity of the remote banking, core banking systems and payment services, along with the implementation of risk monitoring and support of the digital transition. Prior in 2004, he started as a head of consulting department - Information System Security - Bank & Finance in VINCI, the largest construction company in the world by revenue founded in 1899 by Société Générale d'Enterprises. He is also a member of Club of Directors of Safety and business Safety (CDSE).

Dr. Amirudin Abdul Wahab, CEO, CyberSecurity Malaysia, Ministry of Science, Technology and Innovation (MOSTI)

Mr Derek White, Global Head of Customer and Client Solutions, BBVA

Mr Tom Groenfeldtt, Writer, Forbes

Tom Groenfeldt is a freelance reporter who focuses largely on finance and technology, currently writing for Forbes.com in the U.S., for International Finance Magazine, Banking Technology and Mondo Visone in London. He also occasionally writes about art, photography, and local issues for a variety of publications in Wisconsin, where he lives.

Mr David Gyori, CEO, Banking Reports

David Gyori is a globally renowned FinTech consultant, trainer, author and keynote speaker. He is CEO of Banking Reports Ltd London, providing top quality ‘FinTech Training for Bankers’ all over the world. In addition, Gyori holds a number of key international positions: He is founding member of the World FinTech Association as well as member of the panel of judges of the European FinTech Awards. He is co-author of ‘The FINTECH Book’, published by Wiley and Sons in 2016, quickly becoming a global category best-seller. Gyori is faculty member of the Retail Banking Academy (London), one of the most prestigious banker-training facilities globally. He serves on the advisory board of multiple FinTech companies in the United Kingdom.

Ms. Jacqueline Alexis Thng, Partner, Prophet

Jacqueline is a Partner of Prophet in Hong Kong. For over 20 years she has helped clients develop and implement profitable growth strategies across diverse industries both on a global and regional basis. Jacqueline’s expertise includes strategic branding, marketing and sales strategies, business model and product innovation, customer experience as well integrated marketing communications including digital. She was recently bestowed as one of the World's Most Influential Marketing Leaders 2015 by World Marketing Congress. Jacqueline has led many complex reorganization and rebranding projects that involve brand strategy, brand portfolio and architecture. These included United Engineers Group in Singapore, UMW (Malaysia), Celcom (Malaysia), Malaysia Airlines, Fullerton Financial Holdings (part of Temasek Singapore), PSA, NOL and Bank Mandiri. Other clients have included Sime Darby, Petronas, Vodafone, Ericsson, Philips, Telkom (Indonesia), Airtel (India), Limitless (Dubai), Vertu (Nokia), CapitaLand, DBS Bank, Sara Lee, PSA, Shangri-La Hotel, Singapore Aerospace and China Airlines.

Mr. Marcus Treacher, SVP, Customer Success, Ripple

Marcus Treacher is SVP of Customer Success at Ripple. He has over 30 years of experience in transaction banking and payment technology, including 12 years in global leadership roles at HSBC. He served as a member of the Global Board of SWIFT from 2010 to 2016. Prior to joining Ripple Marcus was HSBC’s Global Head of Payments Innovation, applying emerging fintech to solve customer challenges in digital payments, trade and supply chain. Prior to HSBC, he held leadership positions at Citigroup and Accenture. Marcus also works with industry communities, organizations and governments to help shape new payment practices. He chaired SWIFT’s global advisory body for corporates from 2010 to 2016 and is an independent non-executive director of CHAPS Co, the UK’s RTGS clearing company, where he chairs the CHAPS Security committee & User Group.

Dr. Alain Chevalier, Professor of Finance, ESCP Europe

Alain Chevalier is a full Professor of Finance at ESCP Europe. He is also a former Vice Dean, a former Vice Director General, a former Academic and International Dean and a former Dean of Faculty at ESCP Europe. He holds a Ph.D. in Economics (Paris Ouest Nanterre), a Ph.D. in Management (Paris Dauphine) and the French qualification for Ph.D supervision (Habilitation à diriger des Recherches-ESA Lille 2). He created and supervised the Finance concentration at ESCP Europe. He was also Chairman of the Finance Department for several years. Alain Chevalier was also one of the founders of the French Finance Association (AFFI) and is a former President of the European International Business Academy (EIBA). Dr Chevalier is presently a member of the technical committee of the convertible bonds index of NYSE-Euronext and is a board member of several scientific associations in finance, international business and operational research.

Mr Paul Chow, Former Chief Executive, Hong Kong Stock Exchange

Paul Chow - independent Non-executive Director of CITIC Limited, China Mobile Limited, Julius Baer Group Ltd and its major subsidiary Julius Baer Bank Limited. Former Independent Non-executive Director of Bank of China, former CEO and Executive Director of Hong King Exchanges and Clearing Limited, and former Chairman of Hong Kong Cyberport Management Company Limited.

Mr Tod Burwell, President & Chief Executive Officer, BAFT

Tod Burwell is president and chief executive officer of Bankers' Association for Finance and Trade (BAFT). He is responsible for leading the association in its mission to provide advocacy, education and training, and a common industry voice for the global transaction banking community. Prior to joining BAFT, he was a managing director at JPMorgan Chase. Burwell has over 25 years of trade, supply chain and cash management experience as a banking practitioner, as well as serving as a consultant to global corporations and suppliers of strategically integrated trade solutions.