Adama Diakite,

Adama Diakite, Dr. Segun Aina,

Dr. Segun Aina, Dr. Konstantinos Tsanis,

Dr. Konstantinos Tsanis, Chidinma Lawanson,

Chidinma Lawanson, Lola Ekugo ,

Lola Ekugo , Victor Olojo,

Victor Olojo, John Iwuajoku,

John Iwuajoku, Mr. Francis Olugbenga Shobo,

Mr. Francis Olugbenga Shobo, Elliott Kayode Sangoleye,

Elliott Kayode Sangoleye, Dotun Ifebogun,

Dotun Ifebogun, Ayodeji Adigun,

Ayodeji Adigun, Olugbile Erinwusi,

Olugbile Erinwusi, Emmanuel Aihevba,

Emmanuel Aihevba, Kabir Kabo Usman,

Kabir Kabo Usman,

Urs Bolt, Advisor, Wealth & Society Programme

Mr. Bolt has more than 25 years of experience as a senior banker working in the financial services industry, most recently at Credit Suisse. He focuses on wealth management, investment banking, risk & regulation, and financial technology business and his expertise centres on developing and launching new digital business platforms and establishing prime services for high net-worth and ultra-high-net worth clients. His focus is to help financial technology (fintech) and regulatory technology companies and financial service providers review/refocus business strategies, develop products and markets, execute sales, scout for fintech solutions and start-ups, build business partnerships, and implement corporate structures and process.

Dr. Gordian Gaeta, Chairman, Wealth & Society Programme

Dr. Gaeta has been a banking consultant for around 25 years, and is one of Asia’s leading banking consultants and risk control experts. He has advised and served many of the leading financial services organisations across Asia and close to half of the top 100 banks worldwide. He specialises in developing and implementing analytical solutions for complex strategic issues in financial services-related industries undergoing significant change or being exposed to intricate risk issues. Dr. Gaeta has published around 20 articles on banking and financial services and several books, notably “Frontiers in Credit Risk” and “Opportunities in Emerging Markets”. He is also a regular speaker on the international conference circuit, and a Guest Lecturer at several universities.

Mr. Dinis Guarda, CEO and Chief Strategy Officer, Board of Directors, Humaniq

Humaniq is an ethereum-based blockchain banking app building the next generation model for financial services. Launched in 2016, Humaniq aims to provide mobile finance to the two billion unbanked populations through its mobile app that uses biometric authentication to replace traditional methods of ID and security. Guarda is focusing on converting the most advanced technology for sustainable development in the undeveloped world. He is a published author and active in various initiatives that use blockchain and other technologies to advance the greater good in society. He will share with us how disruptive innovation, big data, social media, and technology are disrupting and opening new opportunities for the education, business and financial technology (fintech) world.

Ms. Folasade Femi-Lawal, Head of Digital Banking, FirstBank Nigeria

Femi-Lawal is responsible for the successful launch of the first integrated lifestyle mobile banking App, FirstMobile on Google, Blackberry and Android Appstore with a 4.7 rating within 24 hours. She joined FirstBank in July 2012, as Deputy Head, Mobile Financial Services and helped in taking some giant strides that led to the team changing the face of payments to rural dwellers with significant changes in the mobile money space through partnership with UNICEF towards the disbursement of payments through mobile money to rural women in Northern Nigeria for polio and other communicable diseases eradication. She also developed and executed the strategic partnership of First Bank and Cherie Blair Foundation for Women Empowerment with a focus on recruiting and training 2,500 women agents across Nigeria.

Mr. Adebayo Olarewaju, Head of Digital Banking and E-Business Group, FirstBank of Nigeria

Olarewaju heads the FirstBank digital unit which is responsible for digital transformation of the bank and promoting the adoption of FirstBank’s flagship products - FirstMobile and Online banking - driving growth, managing innovations and excellent customer experience on these platforms. Among other strategic roles, Olarewaju was previously head of acceptance business, responsible for the bank's electronic Channels - ATMs, POS and Web.

Mr. Femi Jaiyeola, Chief Compliance Officer, Diamond Bank

Femi Jaiyeola has a wide range of experience covering internal audit, business advisory, banking operations and compliance with exposure to the financial services industry across Europe, Africa and the Middle East. Prior to joining Diamond Bank, Jaiyeola was the head of audit, Nigeria and West Africa cluster at Standard Chartered Bank. He also served as vice president in the internal audit function of Citigroup, London where he was responsible for the direct supervision of internal audit activities in West Africa. In addition, Jaiyeola worked in the internal audit function of Barclays, London, primarily responsible for managing the assurance activity of Barclays Corporate Bank. Before relocating to the UK in 2005, he was head of internal control and compliance at Bond Bank, Nigeria; and also worked at Arthur Andersen (now KPMG), Citibank Nigeria and United Bank for Africa.

Ms. Onajite Regha, Executive Secretary/CEO at E-Payment Providers Association of Nigeria

Onajite Regha is the founder, executive secretary and chief executive officer of the non-profit organisation, E-Payment Providers Association of Nigeria (E-PPAN), which engages the banking industry and digital payment stakeholders to ensure Nigerian consumers and businesses benefit from world-class payments. Her work with E-PPAN involves advocacy, research, strategy, stakeholder facilitation, and articulation of initiatives that educate and connect people in the payments environment. Regha has over 20 years of experience in media, banking and electronic payment systems. She has previously held positions at Citibank Nigeria and Intermarc Consulting.

Mr. Akin Jones, Co-Founder and CEO, Aella Credit

Akin is the co-founder and chief executive officer of Aella Credit. He was previously the head of investment banking at Primera Africa, Nigeria and prior to that, held key investment banking roles at BGL PLC, Nigeria and SunTrust Robinson Humphrey, USA. Jones started his career in the technology, media and telecoms group at Wachovia Securities and has completed transactions globally with a combined value of over $5 billion. Jones graduated with a degree in international business and finance from Howard University and is one of the very few individuals that has completed three of the leading technology accelerator programs in the world, Y Combinator, 500 Start-ups, and Barclays.

Mr. David Gyori, CEO, Banking Reports London

David Gyori is a globally renowned FinTech consultant, trainer, author and keynote speaker. He is CEO of Banking Reports Ltd London, providing top quality ‘FinTech Training for Bankers’ all over the world. In addition, Gyori holds a number of key international positions: He is founding member of the World FinTech Association as well as member of the panel of judges of the European FinTech Awards. He is co-author of ‘The FINTECH Book’, published by Wiley and Sons in 2016, quickly becoming a global category best-seller. Gyori is faculty member of the Retail Banking Academy (London), one of the most prestigious banker-training facilities globally. He serves on the advisory board of multiple FinTech companies in the United Kingdom.

Mr. Congressman Barney Frank, Former Chairman of House Financial Services Committee, United States Congress

Congressman Barney Frank is the former chairman of the powerful House Financial Services Committee between the turbulent global financial crisis years of 2007–2011. As one of the sponsors of the Wall Street Reform and Consumer Protection Act, also known as the Dodd-Frank legislation, his efforts at closing the gaps in financial oversight such as creating a financial stability council, finding ways to liquidate systemically important firms, and strengthening the financial system against further shocks, were crucial for the recovery of the US financial services industry. Congressman Frank is also credited with many grassroot initiatives, including creating a low-income housing tax credit in the 1980s. He is widely respected by chairmen and CEOs of banks in the US, regulators, and fellow lawmakers.

Mr. Benedict Anyalenkeya, Chief Information Officer, Accion Microfinance Bank

Benedict Anyalenkeya has over 25 years’ experience in consulting and banking with core competencies in technology strategy, electronic banking, channels and product management, retail banking, accounting and project management. He worked as group head of electronic business for Unity Bank, where he built electronic channels leading to exceptional growth on all indices in two years. Anyalenkeya has served as head software/strategy for Continental Trust Bank (now UBA). Thereafter, he joined NAL Bank (now Sterling) and head technical services. He was part of the team that handled the integration of the IT platforms of the banks that formed Sterling Bank before leaving to join the e-business group of First City Monument Bank. At FCMB, he was involved in Implementation of various card brands (like Verve, MasterCard) automated teller machines, point of sale, mobile banking, internet banking and transaction banking products

Mr. Adewale Salami, Zonal Head, Retail Banking Operations, Access Bank

Adewale Salami is responsible for operational, service and customer relationship management of forty-two (42) branches spread across the six states of Nigeria South-South Region. He is also responsible for overseeing the implementation of the Access Bank’s service delivery model and zonal strategy for the retail operations group in line with the group’s strategic goals and objectives, as well as developing and implementing strategies to migrate customers to alternate channels (e-branches, self-service channels, etc) downtime and ensuring effective customer relationship management and deepening relationship with existing and prospective customers. In the past, Salami has also served as head of IT business improvement, enterprise architect and head of infrastructure for Access Bank. Prior to that, he served as head of network and servers for Citibank Nigeria.

Ms. Akin Fadeyi, Head, Financial Inclusion Secretariat, Central Bank of Nigeria (CBN)

Akin-Fadeyi also serves as the secretary to the National Financial Inclusion Governing Committees and Coordinator; Financial Inclusion Working Groups focused on products, channels, financial literacy and special interventions for priority segments (women, youth and people with disabilities). Prior to joining the CBN, Akin-Fadeyi was a management board member and head of banking services of FINCA International; a global microfinance organisation, where she pioneered the banking services department in Uganda and mentored subsidiary heads. She has over 17 years work experience spanning across strategy, operations, digital financial services, microfinance, retail/consumer banking, product development/sales, project management and international money transfers. Since assuming office as the head, financial inclusion secretariat, she has played key roles in advancing financial services to previously excluded population across Nigeria.

Ms. Abimbola Ogunti, Head, Customer Experience, Coronation Merchant Bank

Ms. Abimbola is a customer experience expert with a passion for product development, management and outstanding customer service. Leveraging on her experience in customer service and product management, Abimbola is equipped to deliver year-on-year growth by increasing sales, product development and ultimately customer experience in the financial services/information technology business space. She has a business mind with a specialized skill set to maximize ROI across multiple digital platforms having worked extensively in e-payments, core banking and customer experience roles. She is also well-versed at strategy development in the commercial and merchant banking space. Before her current role, she served as product manager of corporate payments at electronic banking, Fidelity Bank and prior to that, she was the head of customer service at Fidelity Bank Private banking.

Mr. Andrew Agbo-Madaki, General Manager, Africa Fintech Network

Andrew Agbo-Madaki is an information security and fintech expert with vast expertise in cyber threats, payments, media and communications. He is also the general manager of the Africa FinTech Network. Previously, he has worked with the British Sky Broadcasting Corporation. In 2011, he was employed as a senior cyber threat analyst at Cybyl Technologies Ltd in the United Kingdom. Agbo-Madaki serves as Curator of the World Economic Forum’s Global Shapers Community (Abuja).

Ms. Nkoyo Ejiroghene Ekop, Digital Banking Channels Expert

Nkoyo Ejiroghene Ekop is a digital banking channels expert with experiences in the banking industry. Her key roles have been in information systems support and management, digital banking, product management, project management, digital marketing and sales, business strategy, analysis and implementation. Prior to having served at Ecobank Nigeria, she spent over five years overseeing electronic banking channels and virtualisation at Fidelity. Prior to that, she also served as accounts manager and loss prevention executive at Ford Credit Europe Bank, in the UK.

Mr. Francis Gbenga Shobo, Deputy Managing Director, FirstBank

Gbenga Shobo is currently serves as deputy managing director of First Bank of Nigeria. He joined the Board of the Bank in 2012. Prior to this, he was the executive director overseeing the retail banking/public sector businesses in the Lagos & West Directorate and was executive director overseeing the retail business in the South Directorate. Shobo has more than 30 years of work experience from reputable organizations, including more than 26 years in the banking industry.

Mr. Shina Atilola, Group Head, Strategy & Innovation, Sterling Bank

Shina has over 20 years' experience in business strategy, auditing, mergers & acquisition, and financial management. He is a strategic and growth-focused executive with proven record of accomplishment leading teams responsible for designing innovative strategies, identifying emerging opportunities, and executing value-creating transactions. Currently the group head, strategy & innovation of Sterling Bank, one of the fastest growing financial institutions in the West African sub region, Mr. Shina Atilola has established himself as a reputable banker with bias in enabling sustainable businesses over his 18 years banking career. An erudite strategist in the Nigerian banking sector, Mr. Atilola has in his role enabled the bank to develop innovative approaches to doing business as well as in fulfilling the transformation of the new age banking.

Mr. Godwin Emefiele, Governor, Central Bank of Nigeria

Godwin Emefiele has been the governor of the Central Bank of Nigeria since 2014. He served as chief executive officer and group managing director of Zenith Bank, as well as deputy managing director of Zenith Bank in 2001. He also previously served as executive director in-charge of corporate banking, treasury, financial control, and strategic planning at Zenith Bank, and had been a member of the management team since inception. Emefiele has over 18 years of banking experience, and also currently serves as director of ACCION Microfinance Bank Limited.

Ms. Minna Salami, TED Talk speaker and Founder of MsAfropolitan

Minna Salami is a Nigerian, Finnish and Swedish writer, blogger and social commentator who has been listed one of the 12 women changing the world by ELLE Magazine in 2017, which included Michelle Obama and Angelina Jolie. She is the author of the multiple award-winning MsAfropolitan website, and her debut book Sensuous Knowledge will be released in 2019 by Zed and Harper Collins. Salami has served as speaker for some of the world’s most prominent international institutions including Yale University, the Oxford Union, UN Women, and the Singularity University at NASA. She is a contributor to Guardian Opinion and writes a column for the Guardian Nigeria and Huffington Post. She has also contributed to various publications such as The Observer, The Independent, Al Jazeera and The Royal Society of the Arts among others.

Mr. Abu Daramy Kargbo, Head of Retail Banking, Sierra Leone Commercial Bank

Kargbo joined Sierra Leone Commercial Bank in 1987, where he has held senior management positions. Prior to becoming head of retail banking, He was in charge of branch banking, consumer banking, and retail & commercial banking. He has experiences in full cycle banking operations, retail credits, payment system and other business development functions.

Emmanuel Daniel,Chairman, The Asian Banker

Founder of The Asian Banker, the most respected provider of consulting and intelligence in the financial services industry in the Asia Pacific region and other emerging markets. Mr Daniel has led it to become a combination of leading industry research, publication and consulting house, with a strong reputation worldwide.

Mr. Dickson Nsofor, Founder and CEO, The Kora Network

Dickson is a blockchain researcher and advisor to a number of African banks. He was a lecturer at INSEEC Business School London, teaching Blockchain for Finance and Social Good. In 2017, he founded Kora to build infrastructure for inclusive financial systems.

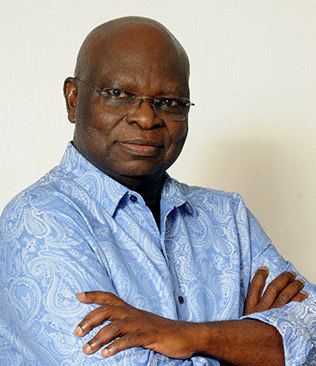

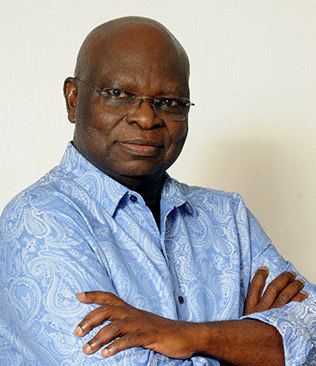

Adama Diakite, Financial Economist & Banking Supervisor, Central Bank of the Republic of Guinea (BCRG)

Adama Diakite is a financial economist and banking supervisor at the Central Bank of the Republic of Guinea (BCRG). His expertise includes financial stability, financial inclusion and the digitalisation of finance. Prior to his current role, he has worked at a commercial bank, and the SocieteGenerale of Banks in Guinea (SGBG). Diakite started his working experience as an intern at the Ministry of Finance and Moroccan Foreign Exchange Office. In 2017, he wrote a dissertation topic about “Financial Inclusion and Economic Development: case of Guinea”. Diakite is also an academic teaching in several universities in Guinea. He has received several scholarships and fellowships, including Chevening funded by UK Government, Mandela Washington Fellowship funded by US Government, and the Guinean-Moroccan Cooperation Scholarship.

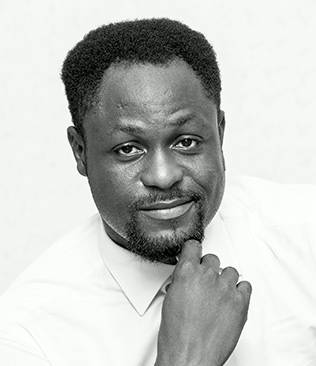

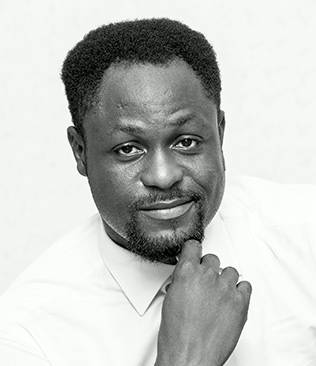

Dr. Segun Aina, President, FinTech Association of Nigeria

Segun Aina is currently the president of the FinTech Association of Nigeria, founded by him in 2002, and the chairman of Global Banking Education Standards Board, which develops and supports the implementation of global standards. He also serves as a member of the UK-Africa Fintech Investment Group, a UK Government initiative co-chaired by the Lord Mayor of London and UK Prime Minister Ambassador for Business Fintech. After his 30-year banking career, he served as president of Chartered Institute of Bankers of Nigeria, from 2012 to 2014. Prior to that, he was the president of West African Bankers Association and the Africa Fintech Network. He holds the Officer of the Order of Federal Republic (OFR) Nigeria National honour.

Dr. Konstantinos Tsanis, Chief Transformation Office, Wema Bank

Konstantinos Tsanis currently serves as chief transformation officer at Wema Bank,leading the innovation and transformation arm of the first digital bank of Africa. He is a seasoned financial technology and digitalisation executive across different continents and industries.In his past roles, he focused on the growth of the corporate incubator within Thomson Reuters, and led the strategy and sales department of Bayzat, the highest funded FinTech start up in the Middle East. Tsanis also contributed in the business development of Bloomberg LP across the Middle East and Africa, advised multiple Fortune 500 companies,and worked as a strategic advisor on improving the performance of EDF Energy,now called UK Power Networks.He is also a member of the Harvard Business Review Advisory.

Chidinma Lawanson, Consultant, International Finance Corporation

Chidinma Lawanson presently consults on a long-term basis for the International Finance Corporation (IFC), from the World Bank Group. She has21 years of experience in operations and business development at Diamond Bank Plc. She was appointed as the bank’s head of micro, small and medium enterprises and Agency Banking, to serve the entrepreneurs and the under-banked, as well as to implement the branchless banking strategies via agency banking until December 2015. Prior to that, in 2012, Lawanson was the head of Human Capital Management, formulating far-reaching changes in digitisation and performance management processes for three years. Lawanson is a senior honorary member of the Chartered Institute of Bankers of Nigeria, an alumna of the Lagos Business School and a member of Institute of Directors (IoD) of Nigeria.

Lola Ekugo, Head of the Digital Innovation Labs, FirstBank Nigeria

Lola Ekugo is the head of the Digital Innovation Labs at FirstBank Nigeria.She is currently at the forefront of the bank’s digital transformation journey through innovation and technology. She also serves on the Tech Committee and has founded various startups, including Transthat.com, a peer to peer logistics platform. Prior to that, Ekugoworked in the corporate sector, occupyingseveral technology rolesand has been working in the start-up scenes in Europe and Africa, with companies like Investec, BNP Paribas and Commerzbank. She received a Portfolio Restructuring Unit Excellence award at Commerzbank for her contribution in 2010. She started her career in the financial services sector as a software developer over 13 years ago.

Victor Olojo, National President, Association of Mobile Money and Bank Agents in Nigeria

Victor Olojo iscurrently serving as national president andchairman at The Association of Mobile Money and Bank Agents in Nigeria (AMMAN). He is also a director from CreditME- Financial Inclusion Services Limited. As a certified Digital Financial Services (DFS) analystwith years of experience in delivering DFS, he is also a member of the federal government team led by the Ministry of Budget and National Planning, where he contributes in developing a five-year social investment road map for Nigeria. Prior to that, Olojo was engaged with the Consultative Working Group (CWG) Committee in DFS policy and regulations championed by the Lagos Business School. In addition to that, he worked closely with Boston Consulting Group on financial inclusion projects and research.

John Iwuajoku, Chief Operating Officer, Royal Exchange Plc

A consummate financial technology expert with over 23 years professional experience in the financial services industry. Currently with Royal Exchange Plc, where He is the Chief Operating Officer. His core focus areas in the company including driving operational efficiency, financial strength, profitability, capital raising and implementation of effective growth strategies and processes. Prior to joining Royal Exchange Plc, He worked at several top financial institution including First City Monument Bank as Vice President/Head, Card and E-Banking Services. He is also a fellow of several institutes and Honorary Associate of the Chartered Institute of Bankers.

Mr. Francis Olugbenga Shobo, Deputy Managing Director, First Bank of Nigeria Limited

Francis Olugbenga Shobo is a deputy managing director of First Bank of Nigeria Limited, as well as one of its board members since 2012. He has over 33 years of work experience, 29 of which are from the banking industry. Prior to his current position, he served as executive director, overseeing the retail banking and public sector businesses in Lagos and the West Directorate. Previously and still under executive director position, he was overseeing the retail business in the South Directorate. He is currently a fellow of the Institute of Chartered Accountants of Nigeria (ICAN) and an alumnus of Kellogg School of Management and Harvard Business School. Shobo began his professional career with Coopers & Lybrand Chartered Accountants as an external auditor and tax consultant.

Andrew McRobert,International Credit & Risk Management Specialist ,Development Banking Consultant.

For more than 20 years, Andrew has been creating and presenting seminars in the Asia-Pacific, Middle East and African markets. He has also undertaken development banking assignments for organisations including CDC, AFDB, ADB, IFC, OFID and DBSA (South Africa). He has written credit manuals, upgraded credit processes, undertaken SME development, privatisation and problem loan management assignments in a wide range of countries and is regarded as a leading expert in problem loan management in emerging markets. His experience in these fields has been gained by working in more than 30 countries in the Asia-Pacific and MENA regions, and across Africa.He is also the author of three professional texts and numerous articles in professional journals.

Copyright 2026, The Asian Banker. All Rights Reserved.