The Asian Banker Summit has always brought political and industry leaders to this the region's largest annual meeting. It is an opportunity to showcase achievements and explain policies to the international community. The Asian Banker Summit features seminal figures in the vein of past speakers such as former US Vice President Al Gore and Former Interim Assistant Secretary of the US Treasury for Financial Stability and Head of the Office of Financial Stability Neel Kashkari.

A fragment of political and industry leaders who have spoken at the Asian Banker Summit

Howard Davies

Chairman, NatWest Group Former Chairman, Financial Services Authority, UK

Barney Frank

Former Chairman of House Financial Services Committee, United States Congress

Chartsiri Sophonpanich

Board Member, Thai Bankers’ Association President, Bangkok Bank

Jimmy Wales

Founder Wikipedia

Umang Moondra

Managing Director APAC, Fidor

Greg Kidd

Co-Founder & CEO GlobaliD

Rosaline Chow Koo

Founder & CEO CXA Group

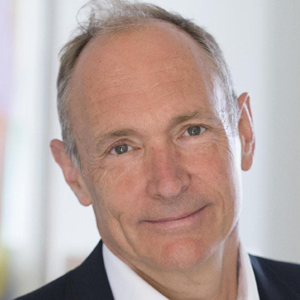

Tim Berners-Lee

Inventor of the World Wide Web, President & Founder, Open Data Institute

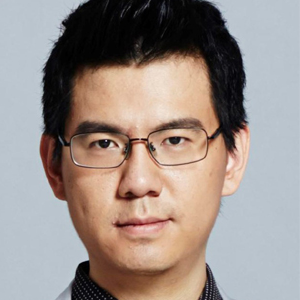

Jackson Cheung

CEO & Co-founder, Youxin Financial

Vladislav Solodkiy

Managing Partner, Life.Sreda and CEO, Arival Bank